Remarkable growth makes its economy one of Asia’s best performers

Vietnam’s economic growth was remarkable prior to 2008. From 2002 to 2007, it maintained respectable annual economic growth of above 7%, comparable to the growth of China and India. In 2007, the country’s gross domestic product expanded by 8.5%; the third consecutive year it surpassed the 8% growth benchmark.

However, things were not as smooth as before. In the first half of 2008, Vietnam’s economy went through a rough patch. Rampant inflation, a rapidly widening trade deficit, a sharp stock market downturn and worrying signs of a lack of confidence in the currency had raised concerns of an economic meltdown. This was followed by the global financial crisis in the second half of 2008.

Despite the rapid downturn in market sentiment in 2008, Vietnam’s economic outlook is not entirely gloomy. All thanks to Vietnamese leaders who historically have responded pragmatically when times were tough.

In the first half of 2008, the authorities unveiled measures to fight inflation. Dramatic increases in policy interest rates, increases in capital reserve requirements for banks and mandated bond purchases by banks were efforts by the State Bank of Vietnam to control spiralling inflation. Within a year, many of the economic issues plaguing Vietnam in 2008 had abated. The inflation which peaked at 28.3% year on year in August 2008 had drastically moderated to 2% in August 2009 and is no longer a pressing concern. The threat of massive depreciation of the Vietnamese dong is over. Trade deficits have also moderated from a peak of US$3.73 billion in April 2008 to US$1.25 billion in July 2009.

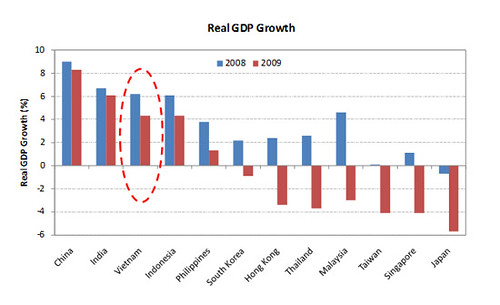

Vietnam appears to be weathering the global economic crisis better than many other Asian countries. In 2009, its real GDP growth is expected to be third largest in Asia – after China and India. This is in part strengthened by the government’s stimulus measures, including tax breaks and an interest-rate subsidy programme, which provided a massive boost to lending.

Vietnam’s housing market in its infancy

The Vietnamese real estate market is growing in tandem with its healthy economic progress. Lack of supply amid growing demand for quality real estate space has and will continue to drive development and price growth in the coming years.

Demand for housing is supported by healthy fundamentals that include:

Favourable demographics: With a population of over 85 million people, Vietnam is the 13th most populous nation in the world. Its population boasts a high overall literacy rate and is relatively young and well educated, all of which translate into a potentially attractive consumer market.

Rapid urbanization: With Vietnam’s large and growing population, the trend, as with all other developing countries, is one towards increasing urbanisation. According to the United Nations (UN) Population Division, while only 85 million people lived in urban areas in 2005, that figure is expected to grow to 90 million in 2010 and to over 102 million in 2020. This works out to be a growth of over one million people in the urban area every year. Rapid urbanisation generates huge demand for real estate space, providing accommodation for the growing urban population as well as to house economic activities.

Rapid urbanisation also means that cities such as Ho Chi Minh City and Hanoi, are experiencing faster population growth. With relatively higher population densities, apartments and condominiums will become an increasingly common form of residential development in these cities.

Growing affluence: In tandem with economic growth, income has also grown rapidly in the past few years. Personal disposable income rose by close to 85% from US$260 in 2002 to US$480 in 2008. According to the Economist Intelligent Unit’s forecast, income will grow by 6% each year over the next five years. In addition, it should be noted that unreported income and wealth may be substantially more than official figures.

The role of overseas remittances in driving the wealth and affluence of the Vietnamese should also not be ignored. Overseas remittances are an important source of additional income that serves to improve the living standards of the people, especially in key cities. According to the Overseas Remittance Management Department of the State Bank of Vietnam, money sent by overseas Vietnamese to their relatives via official channels amounted to US$7.2 billion in 2008. Increasingly, this money has been ploughed into real estate investments.

Property as choice investment: Property ownership is considered a sign of wealth, a form of savings and a long-term investment. With the limited number of avenues for financial investment, investment in property is considered fairly attractive when land and properties maintain a steady growth rate. Moreover, property investment will offer capital preservation.

Favourable developments in the legal and regulatory environment: Property ownership regulations were liberalised in 2001 when the Vietnamese government first allowed certain groups of overseas Vietnamese to own houses in Vietnam. The housing law was further liberalised in 2006 when more categories of overseas Vietnamese were allowed to own properties. Subsequently on September 1, 2009, the law was relaxed again. All overseas Vietnamese are now allowed to own houses, expanding the pool of potential buyers in the residential market.

In another significant development, the National Assembly passed a resolution relating to foreigners purchasing property in Vietnam. According to the resolution, with effect from January 1, 2009, foreign individuals and enterprises who meet certain criteria will be eligible to own apartments in Vietnam for a period of 70 years. This will give an upside to the property market in Hanoi and Ho Chi Minh, especially given the large number of foreign organisations and individuals residing in these cities.

Housing market performance in brief

The global economic slowdown, Vietnam’s high inflation rate and Government policy moves to curb inflation have resulted in the first down cycle in Vietnam’s modern real estate era and increased caution among investors, developers and other market participants.

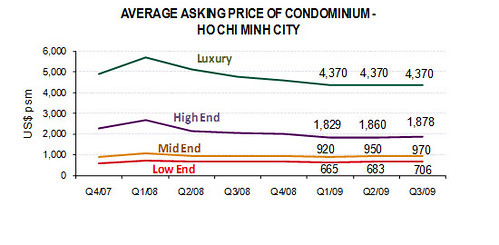

The residential sector in Hanoi and Ho Chi Minh City have seen capital values fall significantly, particularly in the luxury condominium market. However, the second quarter of 2009 witnessed a turnaround in the prices of all condominium segments after four quarters of continuous decline. In the third quarter of 2009, the prices of low to high end condominiums continue to gain momentum. In Hanoi, the condominium prices went up by 8% to 11%, while prices in Ho Chi Minh increased by 1% to 3%.

Vietnam’s economic growth was remarkable prior to 2008. From 2002 to 2007, it maintained respectable annual economic growth of above 7%, comparable to the growth of China and India. In 2007, the country’s gross domestic product expanded by 8.5%; the third consecutive year it surpassed the 8% growth benchmark.

However, things were not as smooth as before. In the first half of 2008, Vietnam’s economy went through a rough patch. Rampant inflation, a rapidly widening trade deficit, a sharp stock market downturn and worrying signs of a lack of confidence in the currency had raised concerns of an economic meltdown. This was followed by the global financial crisis in the second half of 2008.

Despite the rapid downturn in market sentiment in 2008, Vietnam’s economic outlook is not entirely gloomy. All thanks to Vietnamese leaders who historically have responded pragmatically when times were tough.

In the first half of 2008, the authorities unveiled measures to fight inflation. Dramatic increases in policy interest rates, increases in capital reserve requirements for banks and mandated bond purchases by banks were efforts by the State Bank of Vietnam to control spiralling inflation. Within a year, many of the economic issues plaguing Vietnam in 2008 had abated. The inflation which peaked at 28.3% year on year in August 2008 had drastically moderated to 2% in August 2009 and is no longer a pressing concern. The threat of massive depreciation of the Vietnamese dong is over. Trade deficits have also moderated from a peak of US$3.73 billion in April 2008 to US$1.25 billion in July 2009.

Vietnam appears to be weathering the global economic crisis better than many other Asian countries. In 2009, its real GDP growth is expected to be third largest in Asia – after China and India. This is in part strengthened by the government’s stimulus measures, including tax breaks and an interest-rate subsidy programme, which provided a massive boost to lending.

Vietnam’s housing market in its infancy

The Vietnamese real estate market is growing in tandem with its healthy economic progress. Lack of supply amid growing demand for quality real estate space has and will continue to drive development and price growth in the coming years.

Demand for housing is supported by healthy fundamentals that include:

Favourable demographics: With a population of over 85 million people, Vietnam is the 13th most populous nation in the world. Its population boasts a high overall literacy rate and is relatively young and well educated, all of which translate into a potentially attractive consumer market.

Rapid urbanization: With Vietnam’s large and growing population, the trend, as with all other developing countries, is one towards increasing urbanisation. According to the United Nations (UN) Population Division, while only 85 million people lived in urban areas in 2005, that figure is expected to grow to 90 million in 2010 and to over 102 million in 2020. This works out to be a growth of over one million people in the urban area every year. Rapid urbanisation generates huge demand for real estate space, providing accommodation for the growing urban population as well as to house economic activities.

Rapid urbanisation also means that cities such as Ho Chi Minh City and Hanoi, are experiencing faster population growth. With relatively higher population densities, apartments and condominiums will become an increasingly common form of residential development in these cities.

Growing affluence: In tandem with economic growth, income has also grown rapidly in the past few years. Personal disposable income rose by close to 85% from US$260 in 2002 to US$480 in 2008. According to the Economist Intelligent Unit’s forecast, income will grow by 6% each year over the next five years. In addition, it should be noted that unreported income and wealth may be substantially more than official figures.

The role of overseas remittances in driving the wealth and affluence of the Vietnamese should also not be ignored. Overseas remittances are an important source of additional income that serves to improve the living standards of the people, especially in key cities. According to the Overseas Remittance Management Department of the State Bank of Vietnam, money sent by overseas Vietnamese to their relatives via official channels amounted to US$7.2 billion in 2008. Increasingly, this money has been ploughed into real estate investments.

Property as choice investment: Property ownership is considered a sign of wealth, a form of savings and a long-term investment. With the limited number of avenues for financial investment, investment in property is considered fairly attractive when land and properties maintain a steady growth rate. Moreover, property investment will offer capital preservation.

Favourable developments in the legal and regulatory environment: Property ownership regulations were liberalised in 2001 when the Vietnamese government first allowed certain groups of overseas Vietnamese to own houses in Vietnam. The housing law was further liberalised in 2006 when more categories of overseas Vietnamese were allowed to own properties. Subsequently on September 1, 2009, the law was relaxed again. All overseas Vietnamese are now allowed to own houses, expanding the pool of potential buyers in the residential market.

In another significant development, the National Assembly passed a resolution relating to foreigners purchasing property in Vietnam. According to the resolution, with effect from January 1, 2009, foreign individuals and enterprises who meet certain criteria will be eligible to own apartments in Vietnam for a period of 70 years. This will give an upside to the property market in Hanoi and Ho Chi Minh, especially given the large number of foreign organisations and individuals residing in these cities.

Housing market performance in brief

The global economic slowdown, Vietnam’s high inflation rate and Government policy moves to curb inflation have resulted in the first down cycle in Vietnam’s modern real estate era and increased caution among investors, developers and other market participants.

The residential sector in Hanoi and Ho Chi Minh City have seen capital values fall significantly, particularly in the luxury condominium market. However, the second quarter of 2009 witnessed a turnaround in the prices of all condominium segments after four quarters of continuous decline. In the third quarter of 2009, the prices of low to high end condominiums continue to gain momentum. In Hanoi, the condominium prices went up by 8% to 11%, while prices in Ho Chi Minh increased by 1% to 3%.

Article contributed by Dr Boaz Boon and Neo Poh Har of CapitaLand’s research team

Data source: CBRE, Consensus Forecast & CapitaLand Research

Post a Comment

Post a Comment